A Reverse Mortgage in Retirement: Taking out what you put into your house for secure income

Submitted by Concierge Financial Planning, LLC on January 27th, 2015

June and Joe are 73 and 75 respectively. They are happily retired and still living in the home where they raised their three children. Like many people their age, they panicked in the 2008 financial crisis and reallocated much of their portfolio out of stocks—and never got back in. As a result, they do not have an abundance of assets.

Their expenses are low, but they just don’t know how long they are going to live. They always thought they’d have enough money, but the lack of equities in their portfolio and the low returns on their bonds and CDs now have them worried.

June and Joe have tried to cutback. They don’t live a lavish lifestyle, and their greatest joy is to participate in the lives of their children and grandchildren. Both June and Joe have health issues and, frankly, had anticipate parting from this life before money became an issue. Unfortunately, the assets could very well run out before they do, and they are starting to panic.

This story is a common one, and if you feel like June and Joe, do not lose hope. There are always options, even if you told yourself that you would never consider them. I am not talking about something so drastic as abandoning your home and moving in with the kids. After all, they are busy and, if they are like most folks today, can barely provide for their own families and save for college. Nor am I talking about asking them for monetary help. We know that is a burden most families cannot afford.

Instead, many should consider a reverse mortgage. This product has a bad reputation in the past, but the industry has come a long way and it now presents as a viable retirement planning tool. Like June and Joe, many baby boomers own their homes outright. They have paid off their mortgages and their home is now their biggest asset. They can put this asset to good use.

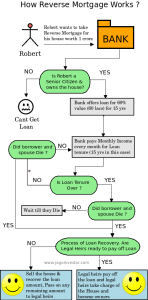

What is a reverse mortgage? Like a traditional mortgage, a reverse mortgage allows one to borrow the equity in a home. The Home Equity Conversion Mortgage (HECM) is the most common type of reverse mortgage and it allows you to monetize your home equity in several ways:

- You can take a lump sum distribution (like a traditional mortgage.)

- You can set up a line-of-credit and draw when you need to (like a Home Equity Line of Credit.)

- You can take regular annuity-like payments for as long as you live in the home.

- You can take annuity-like payments for a fixed number of years.

The reverse-mortgager can either pay back the loan if they have the cash, or when they die or vacate the home, the lender will sell the home. If the home is worth more than the loan, then the heir will be paid the balance. If the home is worth less than the loan, no payback is required as the lender is insured by the FHA (Federal Housing Administration).

So, what’s the cost? There are fees, but they are no longer as cumbersome as they used to be. There are the standard closing costs, which many lenders wave, as well as the FHA insurance, which can be as low as 0.5% upfront. Fees are usually about $5,000 (including the insurance) and are wrapped into the loan, so there is nothing to pay at closing.

June and Joe worked with a reverse mortgage counselor (required) and opted for a variable rate loan that provided regular annuity-like payments for as long as they live in the home. Their home was appraised for $350,000, and they were able to receive $1,314 monthly ($15,700 annually). This is exactly the boost to their income that they needed, and they can be confident the payments will continue until they die or vacate the home. This “income” is tax-free (it’s a loan) and does not affect Medicare premiums or Social Security taxation. June and Joe continue to own their home and pay their property taxes, insurance, and maintenance—just as they would with a traditional mortgage.

June and Joe debated waiting to establish their HECM. After all, they weren’t out of money yet. However, when interest rates are low and expected to rise it’s a great time to set up a reverse line of credit. This is because the amount that can be borrowed is greater when interest rates are low. What’s more, subsequent increases in the line of credit are tied to interest rates. In other words, the unused portion of the credit line grows at the same rate as the borrower’s debt. As rates go up, so does the amount June and Joe can borrow. This is a unique feature of reverse mortgages when compared with traditional mortgages. June and Joe’s initial credit line was $220,000 and in ten years that line will be $380,000! (Assuming a rate of 4.835%.) If June and Joe had waited to set up their line of credit, they would not have been able to borrow as much (because rates would now be higher) and they would not be able to take advantage of the increasing credit line (because they didn’t set up their line earlier). This aspect of reverse mortgages can be tricky. For more information read Jack Guttentag’s great article which explains HECMs dual interest rates.

Over age 62 and think a reverse mortgage may work for you? View your Roadmap to a Reverse Mortgage. I have only touched on the basics here. There are other retirement planning uses for reverse mortgages as well, but I’ll save those for another post.

Read more about reverse mortgages.

Run your own reverse mortgage calculation.