3 Lessons from Ancient Rome’s 3rd Century Inflation Crisis

Submitted by Concierge Financial Planning, LLC on May 22nd, 2022

Inflation. At time of writing the year over year figure is reported to be 8.3%. While (hopefully) not an unfamiliar concept to those planning for retirement, these days the word is on everybody’s tongue. Even for those who make the effort to avoid news, the county’s inflation issue announces itself everywhere in the form of rising prices. Only the most price-oblivious of shoppers could fail to notice, and even they may be induced to do a double take when they see their favorite products seemingly shrinking on the shelves. I’m not an economic expert so while I’ll spare you my hot take on the current situation, I will share an important historical observation. Inflation is nothing new. Inflation is a natural, and in fact inescapable, part of a monetary system. So, give the Fed (or is it Putin?) a break and cast your blame upon the Lydians, the ancient Anatolian people, who, in the 7th century BCE, became minters of the first known coinage.

Inflation. At time of writing the year over year figure is reported to be 8.3%. While (hopefully) not an unfamiliar concept to those planning for retirement, these days the word is on everybody’s tongue. Even for those who make the effort to avoid news, the county’s inflation issue announces itself everywhere in the form of rising prices. Only the most price-oblivious of shoppers could fail to notice, and even they may be induced to do a double take when they see their favorite products seemingly shrinking on the shelves. I’m not an economic expert so while I’ll spare you my hot take on the current situation, I will share an important historical observation. Inflation is nothing new. Inflation is a natural, and in fact inescapable, part of a monetary system. So, give the Fed (or is it Putin?) a break and cast your blame upon the Lydians, the ancient Anatolian people, who, in the 7th century BCE, became minters of the first known coinage.

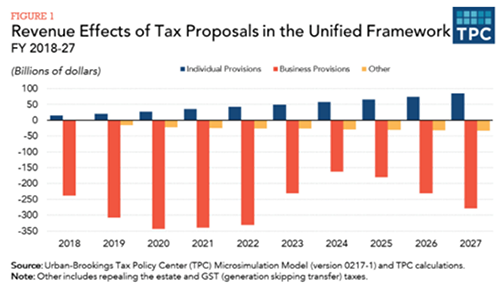

You can be forgiven if you’re skeptical that Congress will be able to completely overhaul our tax system after failing to overhaul our health care system, but professional advisors are studying the newly-released nine-page proposal closely nonetheless. We only have the bare outlines of what the initial plan might look like before it goes through the Congressional sausage grinder:

You can be forgiven if you’re skeptical that Congress will be able to completely overhaul our tax system after failing to overhaul our health care system, but professional advisors are studying the newly-released nine-page proposal closely nonetheless. We only have the bare outlines of what the initial plan might look like before it goes through the Congressional sausage grinder: