The Sweet Spot for Roth Conversions

Submitted by Concierge Financial Planning, LLC on February 17th, 2020

“Should I be converting to a Roth IRA?” asked John recently during our Getting Acquainted Meeting. His is the second most frequently asked question I’ve had over the past six months from both existing and potential clients, so I wasn’t surprised. The media has been focusing on the Roth conversion over the past year and everyone is wondering how they can take advantage of the opportunity.

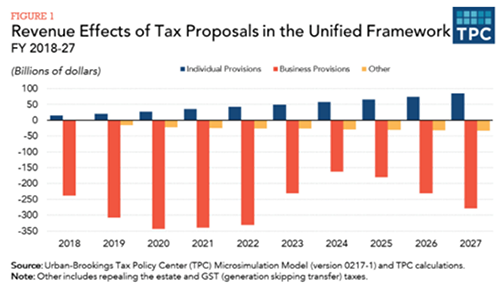

You can be forgiven if you’re skeptical that Congress will be able to completely overhaul our tax system after failing to overhaul our health care system, but professional advisors are studying the newly-released nine-page proposal closely nonetheless. We only have the bare outlines of what the initial plan might look like before it goes through the Congressional sausage grinder:

You can be forgiven if you’re skeptical that Congress will be able to completely overhaul our tax system after failing to overhaul our health care system, but professional advisors are studying the newly-released nine-page proposal closely nonetheless. We only have the bare outlines of what the initial plan might look like before it goes through the Congressional sausage grinder: