Forget Keeping Up with the Jones’—Try Beating Them!

Submitted by Concierge Financial Planning, LLC on April 8th, 2018 “Arghhhh,” I head from the basement as I puttered around my kitchen on Sunday morning.

“Arghhhh,” I head from the basement as I puttered around my kitchen on Sunday morning.

“Arghhhh,” I head from the basement as I puttered around my kitchen on Sunday morning.

“Arghhhh,” I head from the basement as I puttered around my kitchen on Sunday morning.

What if I told you that there is a way to save for retirement without actually having to pinch pennies? You don’t have to deny yourself that shopping spree or that awesome trip. What’s more, you could potentially “save” hundreds of thousands of dollars. Does it sound too good to be true? Well, it’s not. All you have to do is exercise—hard!

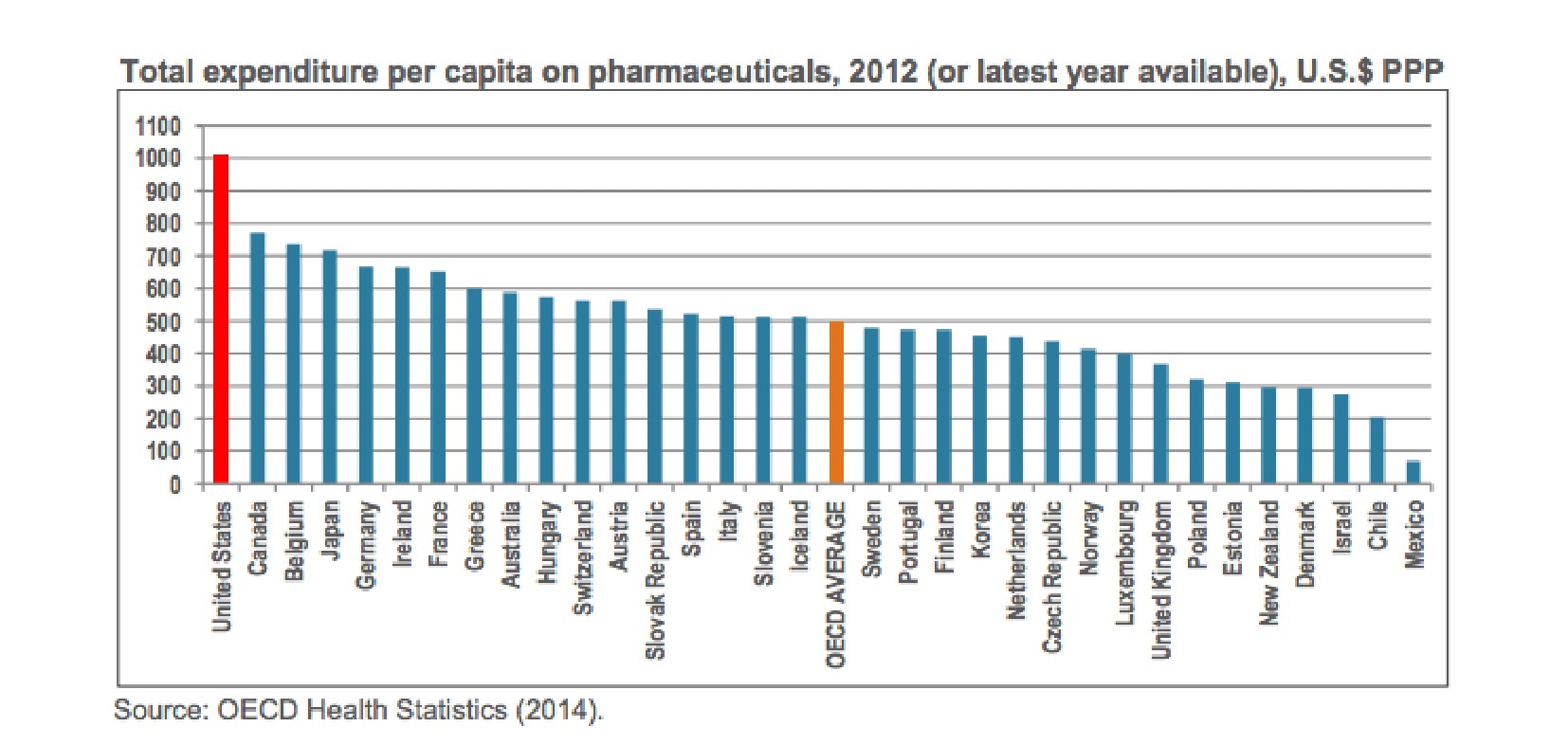

We hear all the time that medical costs are too high in the U.S., and that Medicare is going to go bankrupt in the future. The President-Elect recently told us in a press conference that drug companies are “getting away with murder.” So how high are drug prices, and are those prices contributing at all to the high medical costs in the U.S.?

A Public Citizen research report looked at the prices that older citizens pay for their medications under the Medicare Part D plan, the largest federal drug program, which now covers more than 39 million people. You might be surprised to know that when the plan was passed by Congress under the Bush Administration, Medicare was specifically not allowed to “interfere” with the negotiations between drug manufacturers and pharmacies. The program was prohibited from leveraging its purchasing power to create economies of scale. And that would have been plenty of scale; currently, Medicare recipients account for 28% of all medical drug purchases in the U.S. marketplace.

No doubt you know the statistics: the Social Security program’s reserves are due to run out in 2034. At that point, the only money available to be paid out will be money collected that month from those current workers who are paying into the system. Current estimates say that this will amount to about 75% of scheduled benefits.

There are, of course, a number of solutions. Congress could gradually raise the ages at which future retirees could qualify for Social Security benefits. They could (yet again) increase the ceiling on income on which Social Security payments are collected. Or they could raise the various Social Security and Medicare tax rates on the income below that ceiling.

As Halloween approaches we are all reminded of the scary spooks and ghouls that haunt our lives. Few things are scarier than the sequence of returns risk I wrote about in my lastpost. Like the weather, we cannot control sequence of returns risk, but we can protect ourselves from experiencing its full wrath.

Some crucial maneuvers will help soon-to-retire people avoid trouble.

I recently contributed to this important Wall Street Journal article by Jane Hodges.

The size of your nest egg isn’t the only thing you should be focused on as you close in on retirement.

So say financial planners and experts, who point to several financial moves investors can make in the years before they leave work that might help them preserve their savings, reduce their tax bills and provide for loved ones and heirs.