The Economic Myth-Destroyer Gets his Due

Submitted by Concierge Financial Planning, LLC on October 15th, 2017Imagine a person who always, in every circumstance, makes rational decisions with his money. He saves when he ought to and spends exactly as he should spend, in order to maximize the “utility” of whatever wealth he happens to possess. He defers gratification with ease. When he invests, he has instant and total access to all possible information related to every item in his, including the details of every company’s financials and any impactful world events, even if they haven’t reached the news media yet. If he found a $100 bill on the sidewalk, he would immediately go out and invest it in a steel mill.

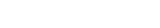

You can be forgiven if you’re skeptical that Congress will be able to completely overhaul our tax system after failing to overhaul our health care system, but professional advisors are studying the newly-released nine-page proposal closely nonetheless. We only have the bare outlines of what the initial plan might look like before it goes through the Congressional sausage grinder:

You can be forgiven if you’re skeptical that Congress will be able to completely overhaul our tax system after failing to overhaul our health care system, but professional advisors are studying the newly-released nine-page proposal closely nonetheless. We only have the bare outlines of what the initial plan might look like before it goes through the Congressional sausage grinder: